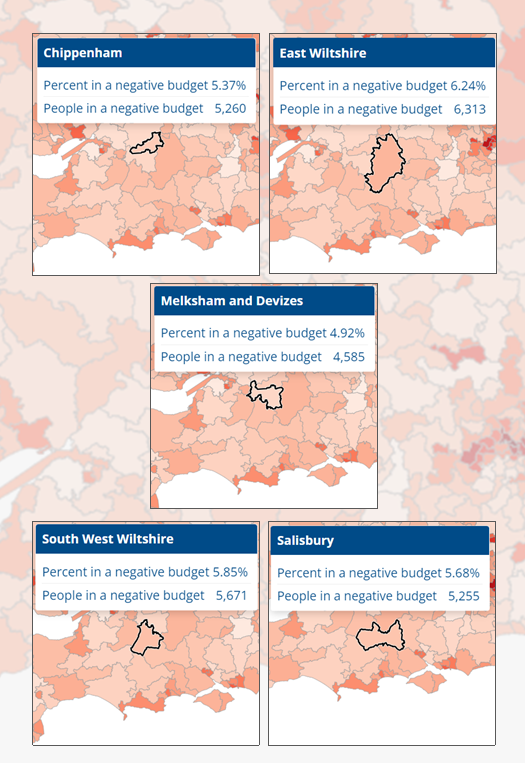

To all prospective parliamentary candidates standing in constituencies within Wiltshire UA, and to whichever party forms the next government,

Families everywhere have a problem. The problem itself is pretty simple. Whether people are choosing between heating and eating, or wondering if they can afford to go on holiday this year, the equation is the same. Does my income cover my costs? Can I afford to live my life, or does every penny go on surviving?

For far too many people the sums just don’t add up!

We’ve heard a lot from political parties about growth and the economy. It’s important, but right now, for many families, whether you can make your household budget add up is the only thing that matters.

At Citizens Advice, we’re helping over 6,000 people with cost-of-living issues every day. That’s everything from trying to pay an energy bill, to covering the rent or getting access to a food bank voucher. These issues exploded in the last few years with spiralling inflation and high energy bills, but many of them have roots that go much deeper — from decades of stagnant incomes to the chronic lack of affordable housing.

The bottom line is we’re hearing from people every day who are finding that their income just isn’t enough to cover their bills.

Nathaniel’s story

Nathaniel* is a single parent working part-time while he cares for his son, who has a long-term health condition. Nathaniel’s son has low immunity and needs to be warm, so his main priority is keeping the house warm and the fridge full. To make ends meet, Nathaniel tried to make a claim for Universal Credit to get the Disabled Child element, but he was unsuccessful. He also picked up extra hours at work. Despite this, they’ve accumulated around £300 of energy arrears and are struggling to afford rent, food and energy. Nathaniel is really worried, especially about his son’s health if they can’t afford to heat their home.

* Name has been changed.

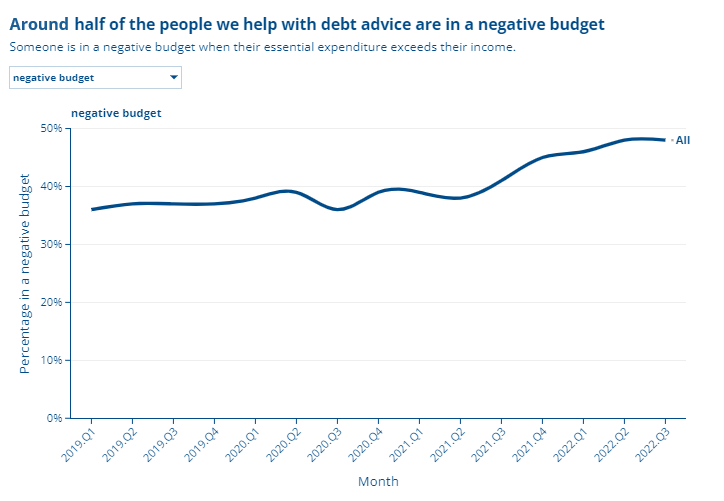

People want to work, to cover their bills, and look after their families. But it’s never been harder. 5 million people are in a negative budget, trapped in the red, no matter what they do, or how many hours they work.

Millions more are cutting back their spending to just about keep their heads above water. Our advisers are doing everything they can to try and make money stretch that little bit further, but for too many people it’s not enough.

It doesn’t have to be this way

Change is possible. It’s a big challenge, but there are things that can be done quickly to start to turn the tide.

Bring incomes back in touch with the real cost of living

Benefits aren’t keeping up with real terms costs. We need them in line with the HCI (Household Cost Indices). This is a better indicator of how much people need in their pockets to get by. Uprating benefits by the Household Cost Indices, rather than CPI inflation, would lift nearly 100,000 people out of a negative budget.

Too many people in work are struggling to cover the essentials. The next government should keep increasing the minimum wage, to ensure more of the lowest earners can rely on their wages to make ends meet.

Tackle the runaway cost of essentials, particularly energy bills and rent

We need to see an expansion of support to help people who are still struggling to pay their energy bill. And we need to expand affordable tariffs for essential services like broadband and water.

The cost of housing — especially private rents — is now one of the biggest drivers of negative budgets. The next government must prioritise giving renters secure and affordable homes, by banning Section 21 ‘no fault’ evictions, tackling unfair rent hikes, and reforming the Local Housing Allowance.

Making these changes will begin to pull people back from the brink - around 1 million people could be lifted out of a negative budget if these policies were implemented. That’s a great start.

Whichever party takes office on 5 July needs a clear plan to tackle falling living standards. How they’ll put pounds in peoples’ pockets, and fast.

Wiltshire Citizens Advice

27 June 2024